Argentina vs. Australia Wine Industries: A Reasonable Comparison?

As someone who has been importing wine from Argentina since the beginning of its rise to popularity in the US, I am consistently fascinated by the comparison and oversimplification of the rise and slowdown of Argentine and Australian US wine imports. This discussion started somewhere around 2010 after Argentina had grown from almost nothing to over 6 million cases in 10 years. I’d like to think that my partner Nick and I had a role in that growth as we founded Vine Connections to import Argentina wine in 2000 when there was barely a category there - when the response to “Do you want to taste a Malbec?” was “Is that a blend of something?”

The origin of the category comparison is understandable. Argentina’s growth was fueled by one varietal, Malbec, to the tune of 65% of all shipments at one point. Likewise, Australia grew with the popularity of Shiraz (Syrah). The fact that both countries make many other good varieties is usually ignored, but that is a topic for another time.

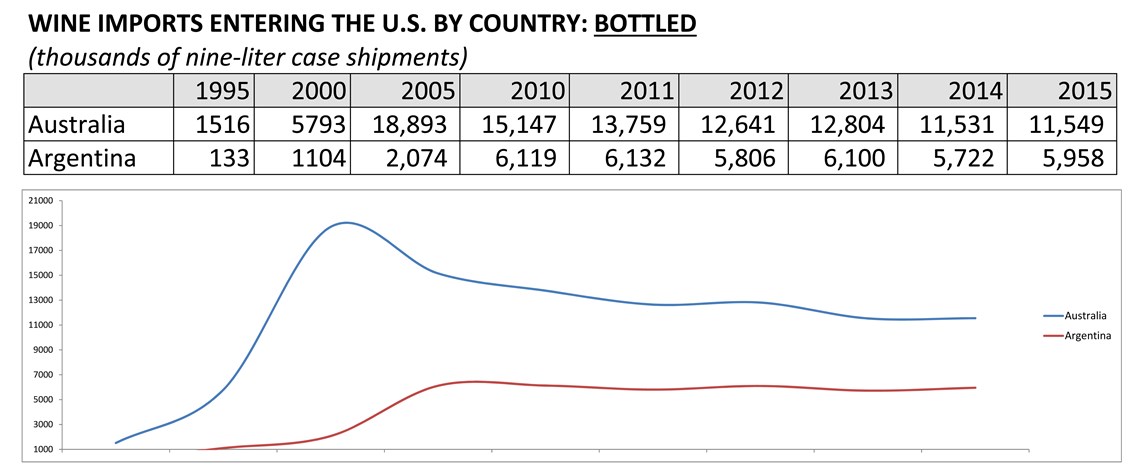

So are Argentina and Australia the same tale of boom and bust based on over-reliance on a single varietal? I don’t think so. First, let’s look at the numbers (All Sources: US Department of Commerce and IMPACT DATABANK.):

Both countries have experienced big success in a relatively short period of time, and both have driven growth with one primary varietal. However, their circumstances are very different from each other.

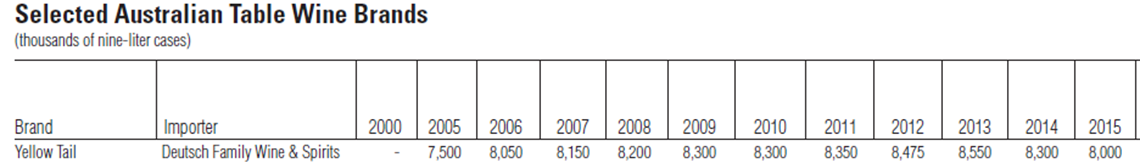

1. Dominance by a Single Brand: There are many very good Australian wines produced, and many that never make it to US shores, but I am not aware of any imported wine brand that has ever grown in US imports as quickly as Yellowtail did—from 0 cases in 2000 to 7.5 million five years later!

There is no similar brand concentration in Argentina or anything close to it. And while Alamos has experienced rapid growth since it moved from Billington Imports to Gallo in 2009 (from ~175,000 to ~900,000 cases), that was well after Argentina had established itself as a major player and with many brand participants. Interestingly, as the Australian category fell out of favor (though still pretty darn big), Yellowtail has continued to this day to sell above case levels they had at the category peak in 2005. It is also interesting to note that Argentine shipments have plateaued near their peak while Australia is 39% off their peak.

2. Political Circumstances: Argentina beats out most other wine countries for political instability, and certainly bears no resemblance to Australia. Argentina managed to rise to prominence in the US in spite of government policies that included export taxes (yes, you read that correctly), import restrictions on winemaking equipment and supplies, and economic policies that led to 40% annual inflation. The fact that Argentine wineries have succeeded over the last 15 years, with one varietal or many, is nothing short of a miracle of perseverance and creativity.

3. Industry Coordination of Efforts: Australia has done a magnificent job working together to research and coordinate a course to overall industry success. The Argentines tend to work more separately. Historically, Argentina's government has been known to change the rules at a moment's notice, making long-range planning almost impossible.

It is easy to say that “Argentina and Australia are following a similar path,” but that is a pretty gross simplification of two very different situations. Yes, they both sold/sell a lot of one varietal, but everything except that couldn’t be more different and those differences are important to the future. Argentina only now has a pro-business (and hence pro-wine) government, and that allows Argentine wineries to invest in a future that will look very different from the past, and probably very different from Australia’s.